INVESTMENT BENEFITS

INVESTMENT BENEFITS

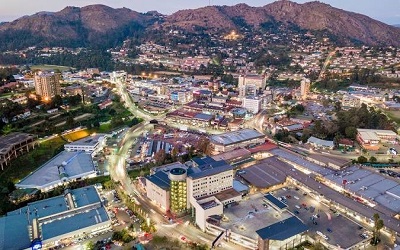

Eswatini has modern infrastructural facilities suitable for export oriented and global companies seeking to gain a foothold in global exports and reduce costs of production/operation, whilst ensuring a safe and well established location. These include reasonably priced and reliable utilities; modern road infrastructure and railway networks; reliable haulage and courier services; and sophisticated banking and insurance facilities.

INDUSTRIAL INFRASTRUCTURE IN ESWATINI

Eswatini has developed excellent industrial estates in the key urban centres, where medium size and large businesses are found. The industrial sites are fully serviced with reliable infrastructure and utilities including:

- Competitively priced, factory buildings readily available from the Ministry of Commerce Industry & Trade, the Eswatini Industrial Development Company and private developers

- A regionally linked electricity supply network that provides a reliable and competitively priced service to all businesses.

- A well developed and robust Telecommunications system that includes mobile cellular system

- Abundant and consistent water supply

INVESTMENT INCENTIVES & GUARANTEES

The government of Eswatini has committed itself towards facilitation of establishing productive enterprises and to reduce the cost of operating expenses, including taxation of the private corporations. Consequently, there are a number of investments which have been put in place that qualifying investments may take advantage of.

Government encourages economic development through private sector initiatives. Foreign and local investment in all business sectors is welcome. The following are examples of investment incentives available to investors.

TAX INCENTIVES

Developmental Approval Order: This tax incentive is available to investors qualifying as a “development enterprise” in terms of issued guidelines. These incentives include a 10% corporate tax rate for 10 years and an exemption from withholding taxes on dividends for the same.

Capital allowances

- Plant and machinery used in the process of manufacture – 50% initial allowance in the first year of use and a 10% annual allowance on the reducing balance method over the lifetime of the asset.

- Hotel construction and improvement allowance – 50% of the cost is deductible in the year in which it is incurred on the construction of a new hotel or beneficial improvements to an existing hotel. In addition, an annual allowance of 4% of such expenditure is allowed.

- Buildings (and improvements thereto) used to house manufacturing plant and machinery – 40% initial allowance in the first year of use and an additional 4% allowance.

- Employee housing allowance – 20% in the first year and 10% per annum for the next 8 years

- Farming – Certain capital expenditure is tax-deductible, but the total deduction in any year of assessment is limited to 30% of the gross income derived by the farmer from farming operations. Any amount disallowed is carried forward and added to expenditure in the succeeding year. Agricultural equipment and inputs are duty free.

Duty free Access on Capital Goods: Capital goods imported into the country as intermediate goods (to be used as inputs for final products) are exempted from import duties.

Duty free Access on Capital Goods: Capital goods imported into the country as intermediate goods (to be used as inputs for final products) are exempted from import duties.

Export Credit Guarantee Scheme: Investors who manufacture/ process for the export markets can obtain funds from local banks to process their orders. The Government of Eswatini, through the Central Bank of Eswatini, guarantees loans for this purpose.

Repatriation of Profits: The liberalized foreign exchange mechanisms also allow full repatriation of profits and dividends of enterprises operating in the country. Repatriation is also allowed for salaries of expatriate and capital repayments.

Agriculture

Manufacturing

Energy

Mining

Tourism

Textile